Real-Time DEX Trading - DeFi Made Powerful

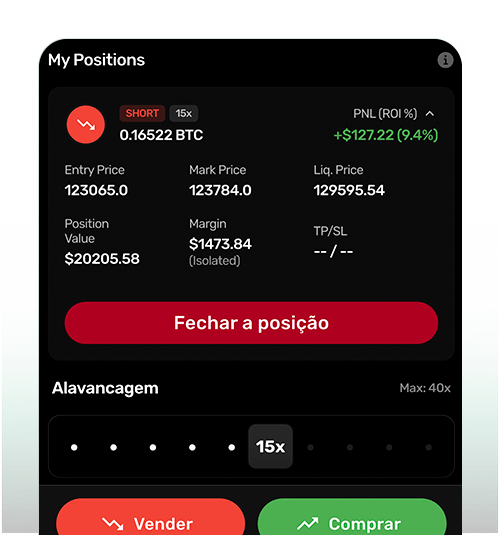

Trade on DEXs, exploring long (buy) and short (sell) positions, margin trading (up to 40x leverage), or even becoming a liquidity provider (market maker).

Explore the Technologies Behind Secure and Frictionless DEX Trading

Whether you're new to crypto or a seasoned investor, EBX app delivers a custom, seamless and tailored experience. Ultra-Fast Decentralized Trading with Agabe DEX

EBX DEX operates with real-time APIs and optimized WebSockets, transmitting validated data streams directly to Prediction Agents, corporate governance dashboards, and financial IoT devices.

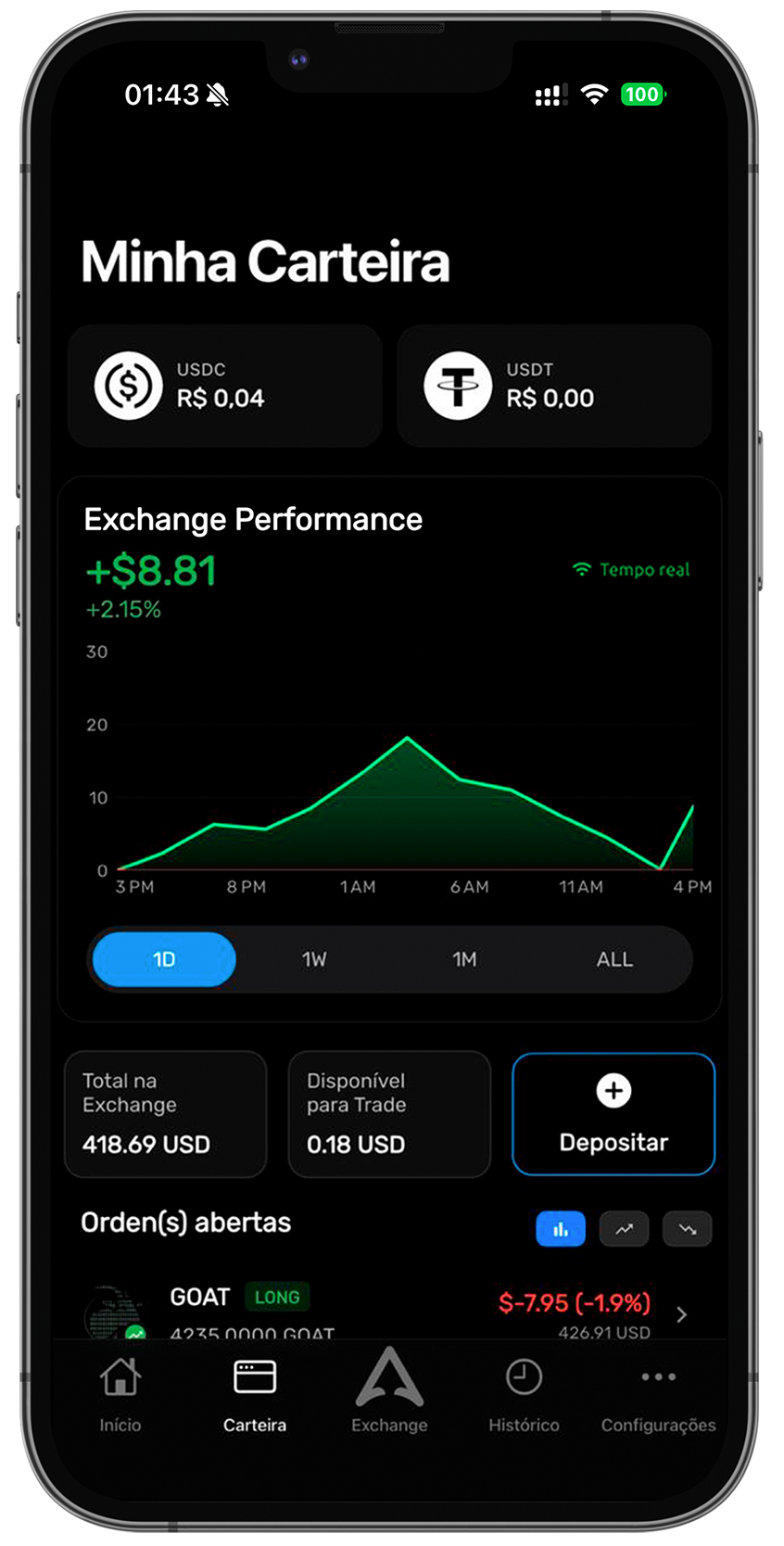

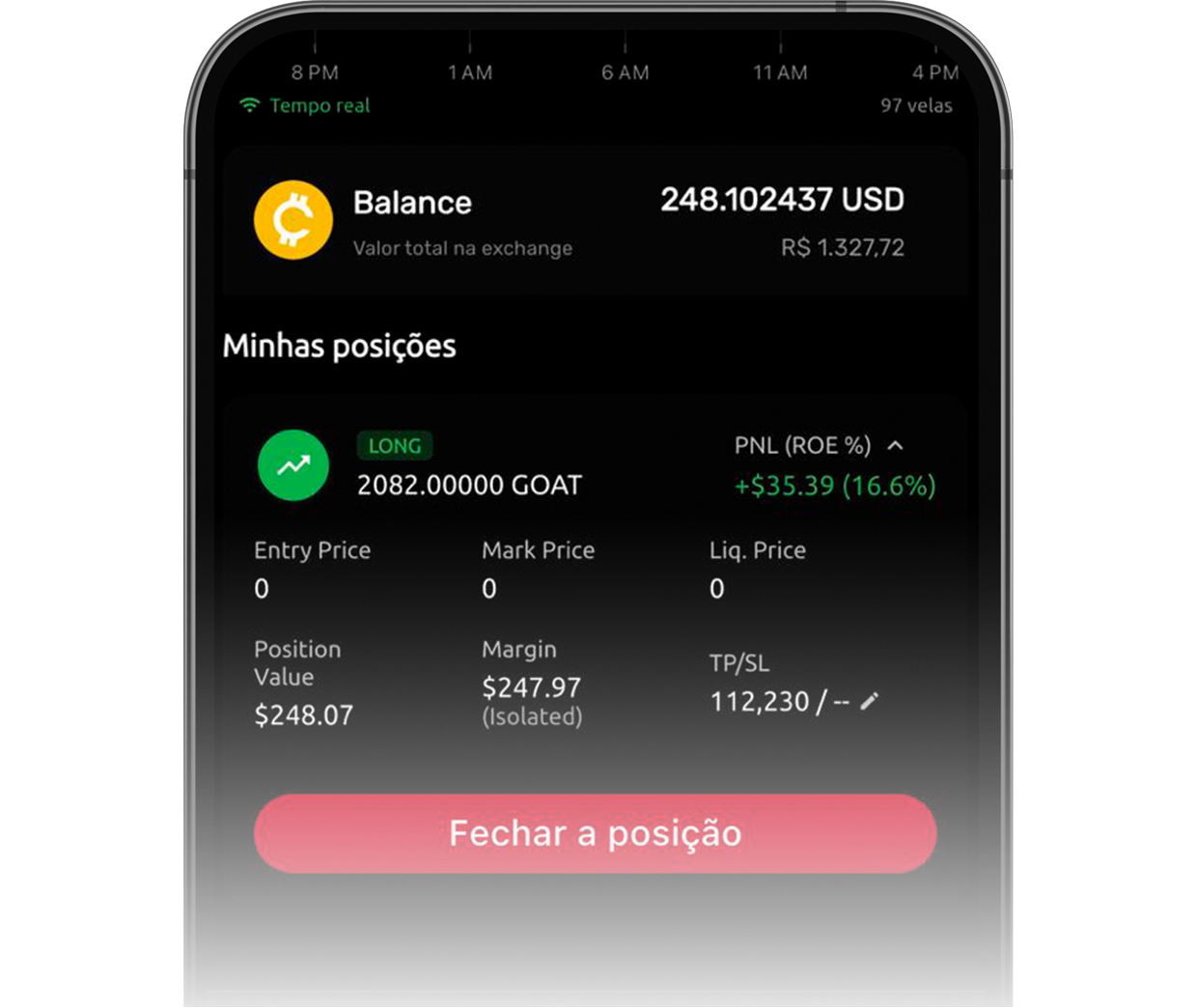

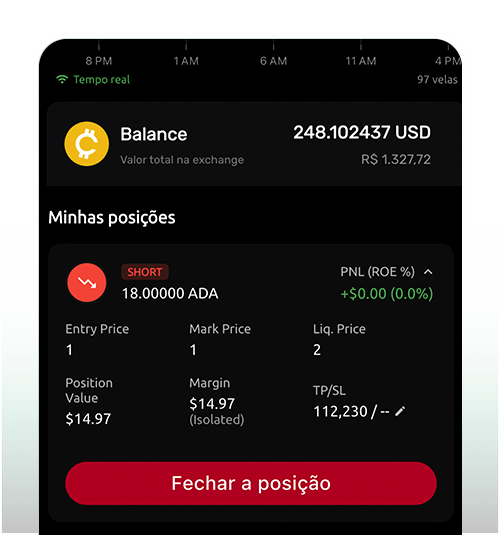

You can track essential information like margin, position value, and PnL (ROI) in real time. Accessible and clear data gives you complete control over your investments.

Always get the best price across multiple DEXs, with automatic slippage locks that protect your operations and ensure safer and more efficient trading.

At EBX DEX, you access an efficient and resilient market with ultra-tight spreads and minimal costs. More liquidity, greater competitiveness, enhanced transparency, and secure operations for everyone involved.

Access to multiple assets

The ability to trade a diverse universe of assets depends on interoperability between different blockchains. With Agabe Exchange, everything becomes much easier and cheaper!

Long Position (Buy)

When you buy an asset expecting its price to rise. This is the most common trade, also known as a "long position."

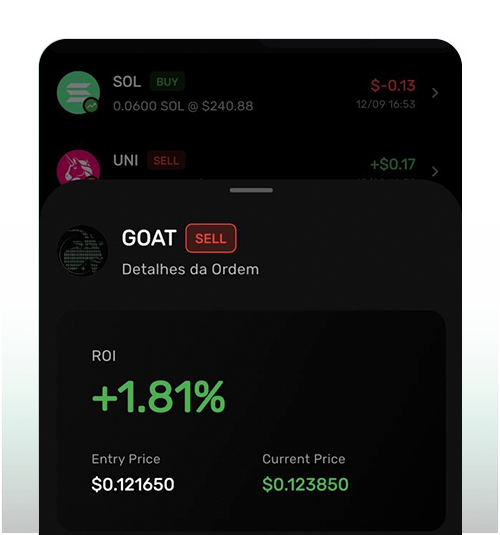

Short Position (Sell)

When you sell an asset you don't own, usually through a loan, with the intention of repurchasing it later at a lower price. This is known as a "short position."

Margin Trading

This involves using borrowed funds to increase your exposure. With up to 40x margin, you can open long and short positions.

Decentralized Exchange

The Engine of the Decentralized Economy

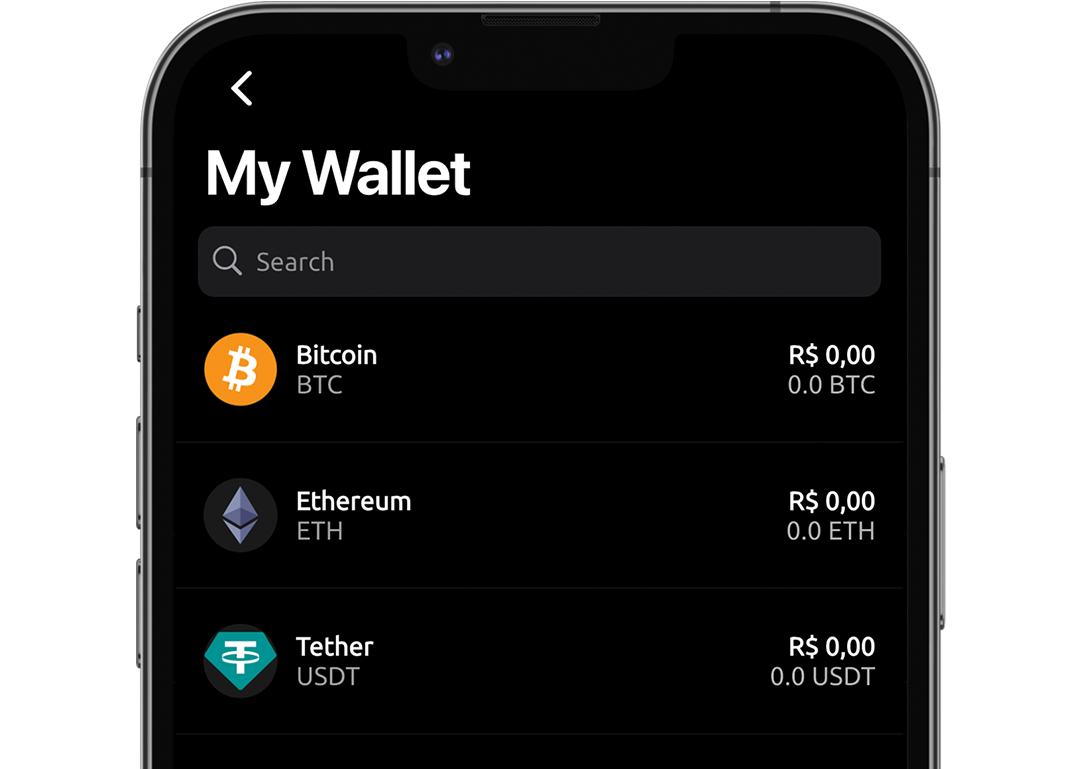

All in one Wallet

Manage your portfolios in one place!

No configuration required; everything is ready to use immediately. Manage your assets securely, quickly, and conveniently. Send, receive, and track balances in real time.

Discover the AGABE Case

FAQ about DEX

(Decentralized Exchange)

EBX Wallet is a digital wallet focused on security, usability, and inclusion, allowing you to buy, sell, store, and transfer crypto assets on a single, intuitive platform.

What is a DEX?

A DEX (Decentralized Exchange) is a trading platform for crypto assets that operates without central intermediaries, allowing users to trade directly through smart contracts. This ensures more autonomy, transparency, and control over their assets.

What is spread in a DEX?

The spread is the difference between the buy price (bid) and the sell price (ask) of an asset. In traditional markets, it represents the implicit cost of liquidity.

In DEXs, the spread depends on the depth of the liquidity pool or the order book (if the DEX uses that model). The higher the liquidity, the tighter the spread—resulting in lower costs for traders.

What does slippage mean?

Slippage is the difference between the expected price of a trade and the actual execution price.This happens because prices can change quickly or because the traded volume impacts the liquidity pool.

In DEXs, users can set a “slippage tolerance” to avoid unexpected losses.

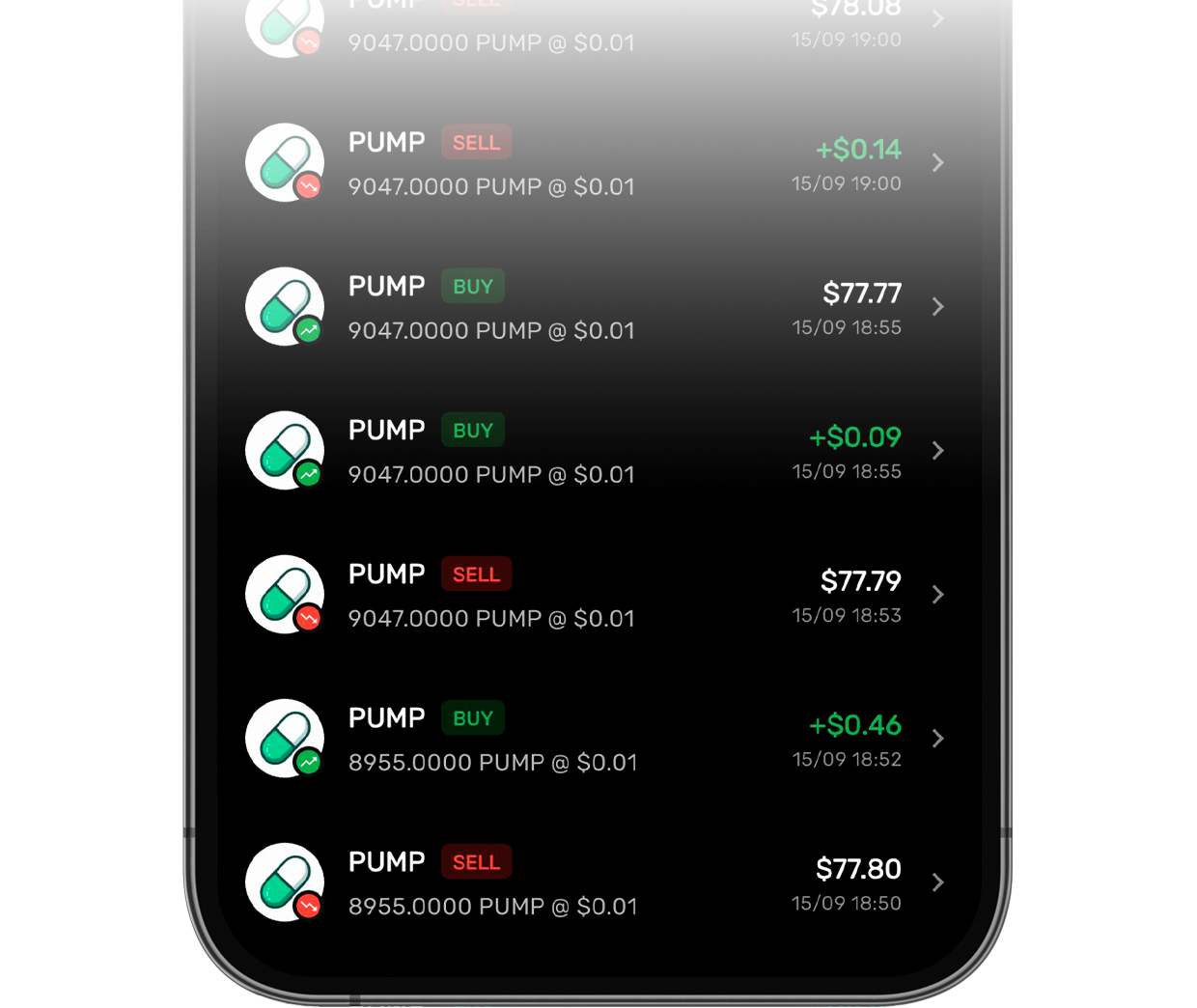

What is PNL in a DEX?

PNL (Profit and Loss) measures an investor’s gains and losses.In DEXs, it’s usually tracked as ROI (Return on Investment) since there aren’t full accounting structures like in centralized exchanges.

Users can track entry price, exit price, current position value, and overall performance to evaluate their strategy.

Are DEXs similar to traditional markets?

Yes, but with key differences:

No intermediaries: execution happens via smart contracts instead of banks or brokers.

Liquidity: provided by liquidity providers in pools instead of centralized market makers.

Risk: no government guarantees or broker coverage—users bear full responsibility.

Transparency: all trades are recorded on the blockchain and can be publicly audited.

Who controls the risks in a DEX?

The investor.

Unlike banks or traditional brokers that may offer protections, in a DEX the user controls:

slippage tolerance,

capital allocation,

risk management (e.g., stop-loss, diversification),

how they handle volatility.

This autonomy is empowering for those seeking independence, but it also demands discipline and knowledge.

Start Your Crypto Journey Today

Join a growing community of digital pioneers. Manage your assets, explore innovative tools, and unlock the potential of cryptocurrency with ease.